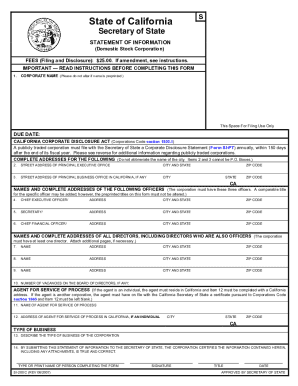

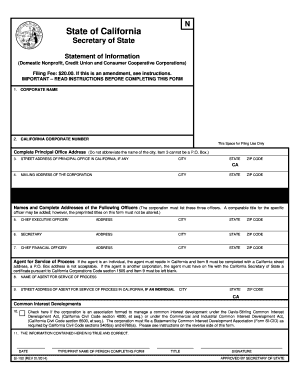

CA SI-200 C 2010-2024 free printable template

Show details

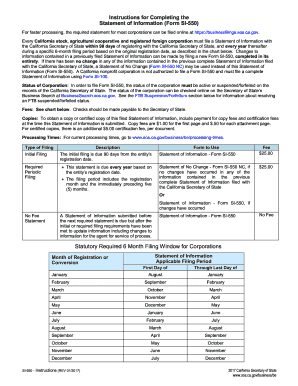

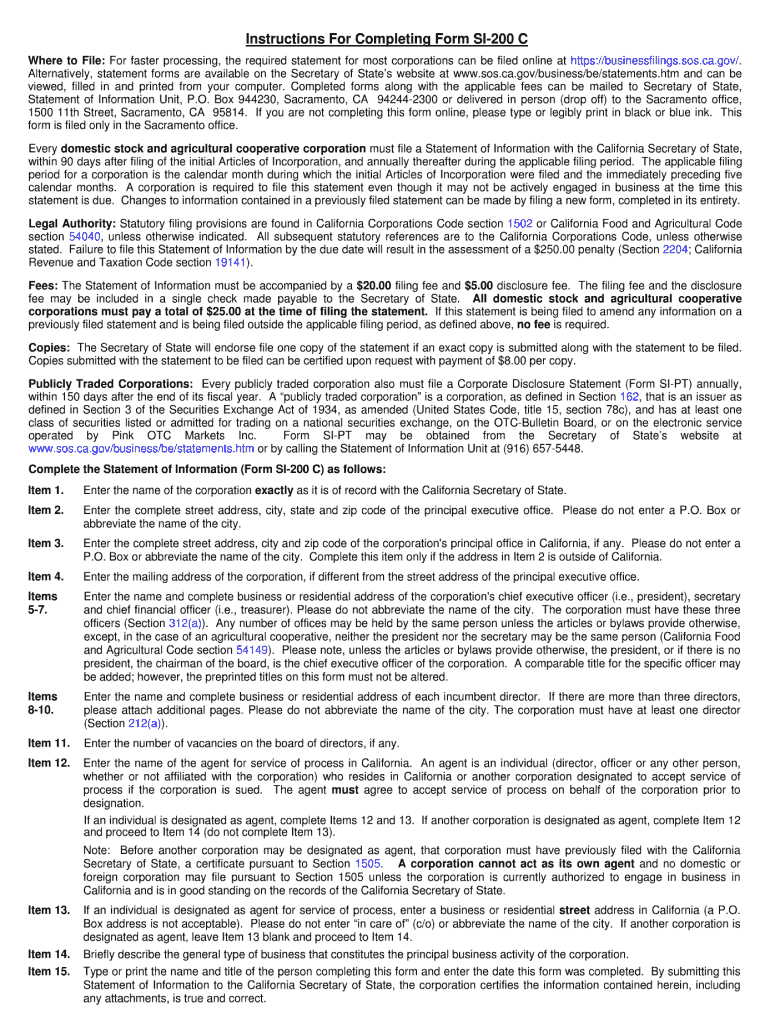

Instructions For Completing Form SI-200 C

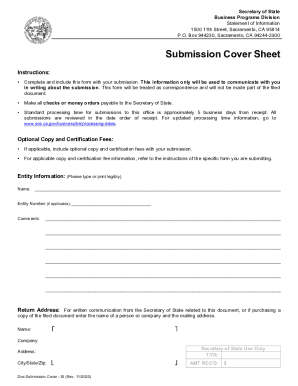

Where to File: For faster processing, the required statement for most corporations can be filed online at https://businessfilings.sos.ca.gov/. Alternatively,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form si 200 2010-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form si 200 2010-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form si 200 online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit si 200 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

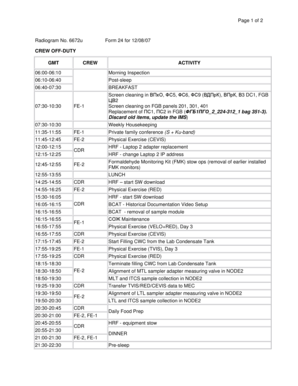

CA SI-200 C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form si 200 2010-2024

How to fill out si 200?

01

Begin by downloading the SI 200 form from the official website of the relevant organization.

02

Carefully read the form's instructions and guidelines to understand the required information and format.

03

Fill in the personal information section, including your full name, address, contact details, and any other requested details.

04

Provide accurate and up-to-date information regarding your employment history, income, and financial situation, as stated on the form.

05

If applicable, include any supporting documents or evidence required for the form. Ensure that these documents are organized and clearly labeled.

06

Double-check all the entered information for accuracy and completeness before submitting the form.

Who needs si 200?

01

Individuals applying for a specific type of license or permit may be required to complete the SI 200 form. This can include professions requiring certifications such as doctors, lawyers, or engineers.

02

Businesses or organizations applying for permits, such as liquor licenses or building permits, may also need to complete the SI 200 form.

03

The SI 200 form is often required for individuals or businesses seeking government contracts or grants. It provides important information about the applicant's financial stability and professional qualifications.

04

In some cases, individuals applying for financial assistance or government benefits may need to fill out the SI 200 form to demonstrate their eligibility and financial situation.

05

It is essential to review the specific requirements and guidelines of the issuing organization to determine if the SI 200 form is necessary in your particular case.

Video instructions and help with filling out and completing form si 200

Instructions and Help about 200 si form

Fill si 200n c : Try Risk Free

People Also Ask about form si 200

How much is the filing fee for SOI?

Do I have to file a Statement of information in California every year?

What is a Statement of information for an LLC in California?

How do I correct my Statement of information in California?

How long does it take to file a Statement of Information in California?

How much does it cost to file a Statement of information in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file si 200?

The Singapore Income Tax Act requires all Singaporean citizens, permanent residents, employees and self-employed individuals to file their income tax returns with the Inland Revenue Authority of Singapore (IRAS) using the e-Filing system. This applies to all individuals who earned income from any source in the preceding year, including salary, bonuses, commission, dividends, rental income and interest income.

How to fill out si 200?

The Form SI 200 is a tax form filed by employers in the state of New Jersey. It is used to report employee wages and to calculate the amount of unemployment insurance tax owed by the employer.

1. Begin by entering the employer's name and address in the appropriate spaces.

2. Enter the employer's Federal Employer Identification Number (FEIN) in the space provided.

3. Enter the period for which the wages are reported in the space provided.

4. Enter the total wages paid to all employees in the space provided.

5. Enter the total taxable wages in the space provided.

6. Enter the taxable wages subject to the unemployment insurance tax in the space provided.

7. Calculate the total unemployment insurance tax due for the period based on the taxable wages, and enter the amount in the space provided.

8. Sign and date the form, and submit it to the New Jersey Department of Labor and Workforce Development.

What is the purpose of si 200?

SI 200 is a course designed to give students an introduction to the field of sociology. The course provides an overview of the discipline, its history, theories, and research methods. It also helps to introduce students to the fundamentals of sociological analysis and introduces them to the major theoretical perspectives in sociology.

What is si 200?

It is not clear what "si 200" refers to as it could have multiple meanings. It could be a typographical error or an abbreviation for something. Could you please provide more context or clarify your question?

What is the penalty for the late filing of si 200?

There is no specific information available regarding a penalty for the late filing of SI 200. It is advisable to check with the relevant authority or consult a legal professional to determine any potential penalties or consequences for late filing.

What information must be reported on si 200?

SI 200 is a financial statement report form used by insurance companies in the United States for reporting financial information to state insurance regulators. The information that must be reported on SI 200 includes:

1. Balance Sheet: This section requires reporting the company's total admitted assets, liabilities, and shareholders' equity.

2. Income Statement: It includes reporting the company's total revenues, expenses, and net income or loss for the reporting period.

3. Statement of Changes in Shareholders' Equity: This section reports changes in the company's shareholders' equity during the reporting period, including capital contributions, dividends, and net income or loss.

4. Statement of Cash Flows: It highlights the company's sources and uses of cash during the reporting period, including operating activities, investing activities, and financing activities.

5. Schedule of Investments: This section provides details of the company's invested assets, including securities held, types of investments, market value, and any unrealized gains or losses.

6. Schedule of Liabilities: It reports the company's outstanding liabilities, such as policy reserves, reinsurance payable, and other debts.

7. Schedule of Reinsurance: If the company has obtained reinsurance for its policies, this section provides details on the reinsurance agreements, premiums, and claims.

8. Schedule of Premiums: It reports the company's written and earned premiums for different lines of insurance business and geographical regions.

9. Schedule of Losses and Loss Adjustment Expenses: This section reports the company's incurred losses and loss adjustment expenses for different lines of insurance business.

10. Schedule of Deferred and Unearned Amounts: It includes reporting policy premiums and other amounts received but not yet recognized as income or revenue.

11. Schedule of Statutory Deposits: If required by state regulations, this section provides information about deposits made with state authorities as a regulatory requirement.

12. Schedule of Other Income and Expenses: It reports any other income or expenses not covered in the income statement.

These are the main sections and schedules typically found on SI 200, but the specific requirements may vary by state or regulatory authority.

How do I edit form si 200 in Chrome?

si 200 form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete si 200 printable form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your si 200 online filing. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit sacramento ca on an Android device?

You can make any changes to PDF files, such as filing statement form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your form si 200 2010-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Si 200 Printable Form is not the form you're looking for?Search for another form here.

Keywords relevant to businessfilings sos ca gov form si 200 nc

Related to information ca statement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.